Table of Contents

Introduction to Pink Diamonds

With regards to money management, diamonds have for some time been viewed as a stable and attractive choice. Among the variety of diamonds available, pink diamonds stand out for their beauty as well as for their captivating investment potential. All in all, are pink diamonds a good investment? How about we dive into the details.

What Are Pink Diamonds?

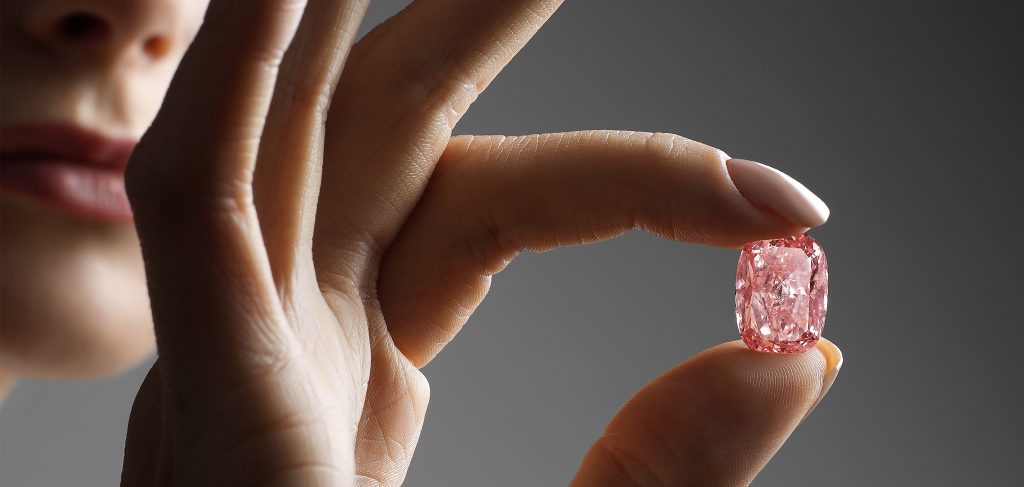

Pink diamonds are a kind of shaded diamond, recognized by their dazzling pink tint. They come in various shades, from soft pastels to vibrant, extreme pinks. Dissimilar to traditional white diamonds, the shade of pink diamonds isn’t caused by pollutions yet rather by an interesting structural arrangement of carbon atoms during their formation. This rarity and beauty make them profoundly pursued.

The Allure of Pink Diamonds

What makes pink diamonds so special? For the overwhelming majority, it’s their ethereal beauty and the way they catch light, creating a captivating sparkle. They represent extravagance and eliteness, making them a favorite among collectors and investors alike. In addition, their association with adoration and romance adds to their appeal, especially in engagement rings.

Understanding Diamond Investments

Why Put resources into Diamonds?

Putting resources into diamonds offers several advantages. They are tangible assets, often resistant to monetary fluctuations, and can act as a support against inflation. Diamonds, particularly rare ones like pink diamonds, have the potential for significant appreciation after some time. Furthermore, they’re easy to store and transport, making them a helpful investment choice.

The Diamond Market Landscape

The diamond market is assorted and complex. While traditional white diamonds dominate the market, shaded diamonds, especially pink ones, are gaining traction. Understanding market dynamics, including organic market, is crucial for anyone considering putting resources into diamonds.

The Extraordinary Value of Pink Diamonds

Rarity and Demand

One of the most convincing reasons to put resources into pink diamonds is their rarity. The majority of pink diamonds come from a solitary mine in Australia, which is nearing consumption. As provisions wane, demand keeps on rising, creating a powerful coincidence for potential value appreciation. Collectors and investors alike are scrambling to acquire these rare pearls before they become considerably scarcer.

Historical Performance

Historically, pink diamonds have shown noteworthy cost appreciation. According to various reports, pink diamonds have outperformed other asset classes, including stocks and bonds, throughout recent decades. This historical performance reinforces the argument for their investment potential.

Evaluating Pink Diamonds as Investments

Factors Affecting Value

Several factors can impact the value of pink diamonds, making it essential for investors to get their work done.

Variety Power and Quality

The power of a pink diamond’s tone is a primary determinant of its value. More profound, more vibrant shades command greater costs. Additionally, the overall quality, including cut and clarity, plays a significant job in deciding its worth.

Certification and Grading

Purchasing an ensured pink diamond from a reputable gemological laboratory is crucial. Certification guarantees the diamond’s authenticity and gives detailed information about its characteristics. While effective money management, always search for diamonds graded by perceived organizations like the Gemological Foundation of America (GIA).

Dangers and Considerations

Market Fluctuations

While pink diamonds have shown a steady upward pattern, the market can in any case be unpredictable. Costs can fluctuate based on monetary circumstances, consumer inclinations, and other external factors. Investors ought to be prepared for the chance of momentary volatility.

Authenticity Concerns

The ascent in popularity of pink diamonds has prompted an increase in imitations and not exactly reputable dealers. Ensuring the authenticity of your diamond through appropriate certification is vital. Putting resources into reputable dealers can assist with mitigating this gamble.

How to Put resources into Pink Diamonds

Where to Buy

With regards to buying pink lab diamonds, it’s crucial to purchase from established and reliable dealers. Whether through auctions, specialized diamond setters, or online platforms, always direct intensive research to guarantee you’re dealing with reputable sources.

Building an Assortment

Putting resources into pink diamonds doesn’t have to be a one-time affair. Many collectors start with a solitary piece and gradually construct their assortments over the long haul. This approach allows you to expand your investment and potentially capitalize on various market segments.

Well-qualified Sentiments and Patterns

Experiences from Industry Professionals

Industry specialists generally view pink diamonds as a sound investment, particularly for the people who appreciate both their beauty and rarity. Many professionals recommend that as awareness of pink diamonds develops, so too will their value.

Future Expectations

Looking ahead, specialists anticipate that the market for pink diamonds will keep on thriving. As the stock decreases and demand remains high, the potential for value appreciation is significant. Putting currently could yield considerable returns from here on out.

Conclusion: Making the Best Decision

All in all, are pink diamonds a good investment? The answer leans toward indeed, especially for the people who value rarity, beauty, and historical performance. While there are takes a chance with involved, determined research, master advice, and a clear understanding of the market can assist investors with making informed choices. Assuming you’re considering an investment in diamonds, pink diamonds may very well be the ideal sparkling addition to your portfolio.